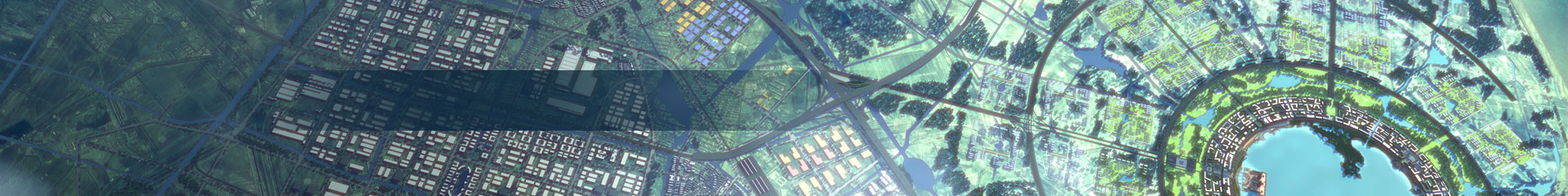

A catalyst for development revving up for more success

Tesla announced on Sept 6 that its gigafactory in the Lingang Special Area of the China (Shanghai) Pilot Free Trade Zone had produced its 2 millionth vehicle.

Tesla's Lingang factory, the first of its kind outside the company's headquarters in the United States, became operational in January 2020 and took just 33 months to generate an output of 1 million vehicles.

The factory then took just 13 months to produce another million vehicles. In other words, a Tesla car is made every 40 seconds in Lingang, said the company's vice-president Tao Lin.

Having an impressive automation rate of 95 percent is one of the reasons why such speedy production is possible. Another reason, said Tao, is the open business environment in Lingang.

Apart from simplifying administrative approval processes, the local authorities in Lingang has helped build a comprehensive new energy vehicle industrial chain over the past few years, and this has in turn enhanced production efficiency.

To date, more than 360 NEV companies have set up operations in the Shanghai FTZ. In 2021, just two years after the official launch of the Lingang Special Area, the annual industrial output of the NEV industry in Lingang had exceeded 100 billion yuan ($13.7 billion). This feat made the NEV industry the first in the area to cross the 100-billion-yuan threshold.

Last year, Lingang's NEV industrial output was 240 billion yuan.

"These achievements are all due to the various innovations made in terms of management mechanism and working processes," said Tao.

The various favorable policies in the FTZ have also been a boon to the development of Blue Buffalo, a high-end pet food brand under US food company General Mills. The company had made its Chinese market debut at the China International Import Expo in 2021 before making the Shanghai FTZ its port of entry.

According to Su Qiang, vice-president and managing director for General Mills in China, the FTZ's policies, especially in the areas of bonded warehousing management, tax incentives for imported pet food, pet whitelist policies, customs declaration procedures, commodity inspection exchanges, and information integration, have been very "practical and precise".

Su said the policies have also been helpful in connecting the company with major distribution platforms such as Tmall. In fact, the FTZ policies even contain detailed guidance regarding multiple types of packaging, and this attentiveness to details has helped the company shorten the time required for products to enter China, he added.

"China's pet food industry is developing rapidly and consumer demand is escalating. The close ties that we have built with the Shanghai FTZ has helped Blue Buffalo to seize the opportunities and address the trends in the Chinese market, as well as build up our brand awareness and improve customer loyalty," he said.

Looking ahead, Blue Buffalo, which launched its Tmall flagship store two years ago, will strengthen its cooperation with more FTZs in China and tap more offline retail channels this year, said Su.

Amundi BOC Wealth Management Limited, the first joint venture of its kind in China, is another company that has grown quickly since settling down in the Lingang Special Area of the Shanghai FTZ in May 2020. Over the last three years, the company has rolled out nearly 300 products and built a team of about 80 people from around the world.

Amundi, the largest asset manager in Europe that as of June 30 had $2.13 trillion in assets under management, holds a 55 percent stake in the jointly held wealth management company. According to Liu Fangzhou, Amundi BOC's sales and marketing director, the company decided to set up an office in Lingang mainly because of the various governmental support provided.

The then China Banking and Insurance Regulatory Commission, which is today incorporated into the National Administration of Financial Regulation, had approved the establishment of Amundi BOC in December 2019. Five months later, the joint venture was officially unveiled in Lingang despite the pandemic.

"We have benefited much from the highly efficient company registration process in Lingang and its favorable talent policies," said Liu.

While most of Amundi BOC's issued products are fixed income-based, the company received permission to trade derivatives and foreign exchange earlier this year, and this will help the company further expand its businesses in China.

"We understand that the Lingang administration is very progressive when it comes to planning cross-border finance and cross-border data management. We would like to work closer with the local government to seek more business opportunities," said Liu.

According to Yuan Guohua, deputy-secretary of the Party working committee of Lingang Special Area, new business models such as cross-border finance, offshore financial services and green finance should play a part in the development of the financial industry in Lingang.

Looking ahead to the next decade, Tao said she believes even more measures will be taken to further optimize the business environment.

"We believe that there will be more achievements in this regard in the Shanghai FTZ, and this will make the zone a global role model in facilitating the development and innovation of companies," she said.

-

Address No 200 Shengang Avenue, Pudong New Area, Shanghai, China

-

Zip Code 201306

-

TEL +86-21-68283063

-

FAX +86-21-68283000